Forty Seven BANK

Forty Seven is a unique project built to create a modern universal bank both for users of cryptocurrencies and adherents of the traditional monetary system; a bank that will be acknowledged by international financial organisations; a bank that will correspond to all the requirements of regulators.

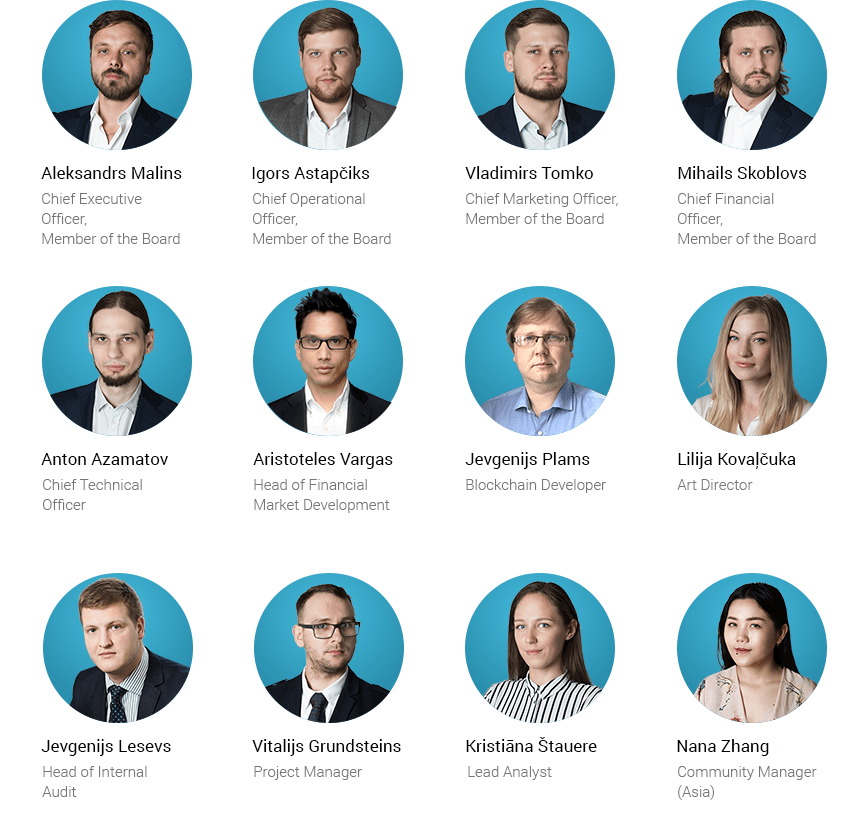

A team of professionals from the worlds of banking, finance, and IT with expertise and experience in the creation and licensing of payment systems, and building of electronic financial institutions will work to realise the goals of the project.

Our bank will become the biggest structure that corresponds to all the requirements of regulators and the EU Payment Services Directive 2 (PSD2). We will comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) policies in order to guard against agents of the “grey” market.

Forty Seven is based on three principles: relevance, convenience, and security. Our specialists use up-to-date technological developments such as blockchain, biometrics, smart contracts, machine learning and many others. If you are interested in the specific details of our establishment and creation of a hi-tech bank.

Forty Seven Mission

The mission of Forty Seven Bank and management team is to provide safe, innovative and user-friendly financial services and products to our customers – individuals, businesses, developers, traders, financial and governmental institutions.

Forty Seven Bank is a bridge capable of connecting two financial worlds and establishing efficient communication between them, a communication that will open up possibilities to level up the whole modern financial system.

Forty Seven Is Innovative products for everyone

- The featured product is a Multi-Asset Account for private customers with a tied card.

- Remote identification and authorisation based on passport and biometric data

- Unique combination of payment tools – SWIFT, credit and debit cards, e-wallets, secured cryptocurrency payments

- Transactions with any type of cryptocurrency through the bank’s application and with no need to wait for current exchanges. Uploading, withdrawal, and conversion by any pair is available

- Wide range of services including crediting, insuring, invoice presentation, credit/debit card management etc.

- Cross-platform access for clients to manage accounts opened with any European bank that complies with the PSD2 directive

- Convenient and user-friendly UI

- Analysis that helps a client to make the right financial decisions via services of a personal manager created on the basis of machine learning algorithms

Forty Seven is Propositions for business

- Business products oriented towards small and medium-sized enterprises.

- Managing an account via Application Programming Interface (API), creation of financial applications

- Receiving payments from a merchant in both cryptocurrencies and in fiat money on the company’s account (card, SWIFT) using a form or API

- Mass payouts for marketplaces

- Loyalty management for clients using big data

- Factoring services based on the operation of machine learning and big data (artificially intelligent algorithms able to predict the probability of repayment of credit as well as timeliness of repayment from a company)

- Escrow services

- Mobile application with biometric identification for multi-currency transactions

Products for Private Persons

Account Management : Forty Seven Bank clients will have a lot of possibilities related to account management. Having access to just one application, a customer will have access to all his accounts in dierent banks at one place it will be easy to manage personal finance in such a way. Besides that, a client is going to have access to all his crypto wallets, investments in traditional financial assets (stocks, bonds, commodities, etc.) and credit or debit cards. This is a featured product oered by the bank and it is called a “Multi Asset Account”. The product will reduce complexities of using dierent types of assets by centralising all the financial activities of our private customers at our single system. It will be easy to quickly transfer resources from one fiat currency to another, or from fiat currency to a digital currency, or vice versa. Moreover, transaction costs will be reduced substantially by doing that at Forty Seven Bank. Our App Platform will also allow clients to use several analytical applications that might help in personal finance management.

Invoicing Forty Seven Bank will support its customers who are oering small products and services as individuals without having a company. Such individuals might be freelancers, copywriters, developers, translators, handcraft professionals, etc. The bank will provide user friendly and simple invoicing services for such customers. By using the service, a client will be able to automatically issue invoices and receive both fiat and nonfiat funds to cover them.

Deposits and Loans The bank will oer deposits and loans in traditional fiat currencies like EUR, USD and others, as well as in non-fiat digital currencies like BTC, ETH and others. At the moment, there is no financial institution in the world that is oering similar products in non-fiat digital assets, whereas we see that there is huge potential in developing and introducing classic banking products for non-fiat digital currencies.

Investments and Brokerage Individual clients will have opportunities to create and manage their investment portfolio by using investment and brokerage services provided by Forty Seven Bank. The bank is going to develop its own exchange in addition to partnering exchanges that could be connected to by using Forty Seven Bank platform via API.

Other Services The bank will also oer traditional products and services like insurance, payments and transfers, payment history and analysis, cash withdrawals at Forty Seven Bank Smart ATMs, as well as at ATMs of our partnering banks. Additionally, Forty Seven Bank will provide smart support with integrated machine learning technologies to our individual customers — it will help to resolve issues between the bank and its customers in evective way.

Executive Team

Advisory Team

Detail Informations

· Website : https://www.fortyseven.io/

· Telegram : https://t.me/thefortyseven

· Twitter : https://twitter.com/47foundation

· FaceBook : https://www.facebook.com/FortySevenBank/

· Bitcointalk ANN : https://bitcointalk.org/index.php?topic=2225492

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1692321

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1692321

Komentar

Posting Komentar