Lendroid: A Decentralized Digital Asset Lending Platform

Introduction

Lendroid is a trustless, open, peer to peer digital asset lending platform based on the Ethereum blockchain. The Lendroid marketplace enables borrowers to avail instant low-cost digital asset loans and lenders to earn interest on the digital assets they lend. Additionally, Lendroid support token (LST) holders act as guarantors of these loans by locking up their LSTs as secondary collateral. The Lendroid platform is extensible by design and allows the creation of loan markets on any ERC20 token.

Overview

The objective of Lendroid is to create a loan marketplace where borrowers can raise funds at fair interest rates instantly, and enable lenders to earn fair and continuous returns on the funds they are willing to lend. This paper introduces three-party loan contracts and loan markets. It also explains how they help achieve the objective stated above.

The three-party loan contract introduces guarantors, borrower and lenders onto a loan contract. The guarantor helps increase the lender's confidence and reduces the collateral burden on borrowers.

Each loan market defines the type of the digital asset and the amount (as a ratio) required as the primary collateral for loans issued on it. The guarantors and lenders can submit offers to the market (signaling their intention to participate in the market) even before any loan requests start flowing in.

With the markets funded, the borrowers choose a market that suit them – instead of having to negotiate the terms of the loan. This process removes the need to approve and arrange funds for each loan individually. The market also encourages competition among lenders. As a result, interest rates are brought down. Loans issued have a fixed expiry. However, the markets never expire.

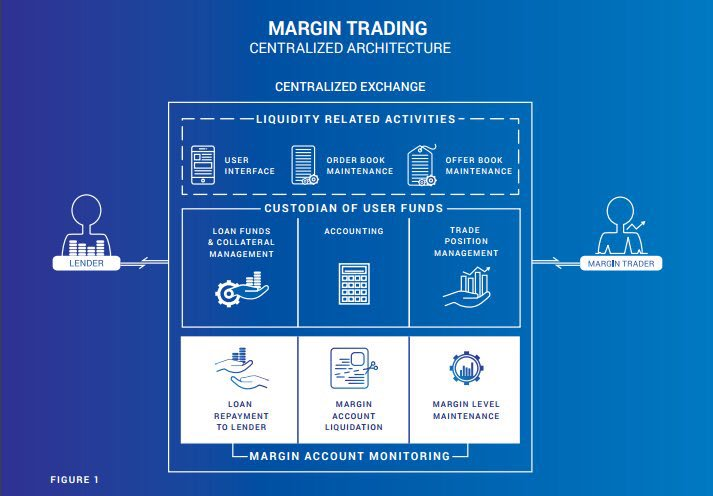

What is Margin Trading?

If a trader wishes to monetize his confidence in the price of an asset increasing/decreasing, he would take a position by purchasing/selling the asset. If he is extremely certain, he would build a leveraged position by borrowing additional funds from a lender to magnify his profits.

How does Lendroid enable lending and margin trading?

Lending - A borrower pledges digital assets into an escrow account, with specific terms for the loan set in a smart contract. If the lender’s and borrower’s terms match, the smart contract is executed, locking in the collateral and releasing the funds to the borrower funds. If the loan obligations are satisfied by the borrower, his collateral is unlocked automatically. If the borrower defaults or the collateral drops below the agreed loan to value, the collateral is liquidated. Margin trading - A margin trader starts by depositing collateral. The trader is allowed to borrow up to a certain leverage to the point where the margin level is greater that the initial level (set through community governance). The borrowed funds come from the shared lending pool to which the lenders can submit offers. With the borrowed funds, the trader interacts with order-books to calibrate positions to reflect expectations from future price movements. Once the traders feel it’s time to unwind their position, the trader once again interacts with the order book. If the trader made a profit, he can repay the lenders and withdraw the profit along with his collateral. If a loss is incurred, the trader is expected to deposit the difference to compensate for the losses, repay the loans in full and only then withdraw collateral. If the account reaches liquidation levels, the wranglers step in and take over the account/positions.

What type of digital /assets/tokens are supported by Lendroid?

Lendroid is compatible with any ERC20-based token. This gives the margin trader a high level of flexibility with respect to the nature of collateral he can deposit against a loan. A Margin Trader is free to deposit not just one kind of collateral in a token of his choice, but multiple kinds of ERC20-based tokens at the same time, in the same margin account. In what is envisioned as a community-driven governance model, the protocol will add or remove support for a token based on the current volatility of the token.

Lendroid Support Token

Rate: 1 ETH - 48 000 LST

Bonus - 25% of TGE tokens reserved for pro-rata distribution among contributors who optionally vest for 2 years.

Hard Cap - 5000 ETH

Token Supply - 12 000 000 000 LST

Released in Public TGE - 240 000 000 LST

Accepted Currency - ETH

Roadmap

Lendroid Team

Detail Informations :

Website : https://lendroid.com/

Whitepaper : https://lendroid.com/assets/whitepaper.pdf

Twitter : https://twitter.com/lendroidproject

Telegram : https://t.me/lendroidproject

Telegram Bounty : https://t.me/joinchat/GJ8FDBGLY_noGHSBieE8lQ

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1692321

Komentar

Posting Komentar